M Climate Solutions

International Equities – Climate Theme

Art.9

« Investing in solution providers enabling the decarbonization of the economy »

Key Points

- A thematic international equity fund targeting companies that generate a tangible impact on the energy and ecological transition for the climate.

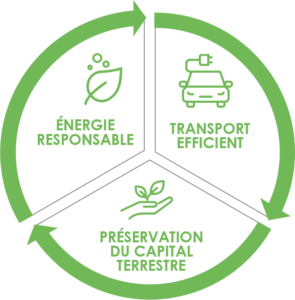

- There are three major transition drivers that are essential to invest in:

- Responsible Energy: Encompasses all solutions in renewable energy production, technologies driving their development (storage, efficiency), and energy efficiency.

- Preservation of Natural Capital: Focuses on the most innovative technologies in waste recycling, water treatment, and responsible production and consumption.

- Efficient Transportation: Includes all solutions supporting the development of alternative and low-carbon transportation modes.

Inception date

2 July 2019

Legal status

UCITS V coordinated mutual fund under French law

AMF classification

Global Equity

PEA eligible (France only)

No

Currency

EUR

ISIN Codes

FR0013446812 (M Climate Solutions C),

FR0014002SD6 (M Climate Solutions D),

FR0013476678 (M Climate Solutions R),

FR00140072X2 (M Climate Solutions IPC)

Cost

Refer to the Prospectus and the KID of each share available above in the Documents section.

Investment management company

Montpensier Arbevel

Custodian

Caceis Bank France

Valuation

Daily (Caceis Fund Administration)

Cut-off

Refer to the prospectus and contact the banking institution through which the order was placed.

Investment horizon

Greater than 5 years

Approved for distribution in

France, Switzerland, Luxembourg, Italy (Institutional Investors)

Centralist

Caceis Bank

Transfert agent

Caceis Bank, Luxembourg branch

SFDR

9

The decision to invest takes into account all the characteristics, objectives, and risks of the UCITS as described in the regulatory documentation of the UCITS: prospectus, KID, pre-contractual SFDR document if applicable, which should be referred to before making any final investment decision. The figures mentioned relate to past years. Past performance is not a reliable indicator of future performance. The UCITS presents a risk of capital loss.

ISIN: FR0013446812

VL

297.01 €

02/02/2026

Risk Indicator - SRI

The risk indicator is based on the assumption that you hold the product for 5 years. The actual risk may be very different if you choose to exit before the recommended holding period, and you may receive less in return. You may risk selling your product at a price that significantly affects the amount you will receive back.

Documents

Main Risks

- Risk of capital loss

- Risk related to discretionary management

- Equity risk

- Sustainability risk

- Other risks : Risk associated with investments in small- and mid-cap securities. Risk related to the use of derivative instruments. Liquidity risk. Emerging markets investment risk. Interest rate risk. Credit risk. Risk related to speculative securities. Risk related to convertible bonds. Counterparty risk.

All risks associated with this product are detailed in the fund’s prospectus. Please refer to it for further information.

YTD

5.13 %

5 years performance

24.44%-25.17%-37.50%

18.86%-22.69%-13.48%-19.34%-2.77%